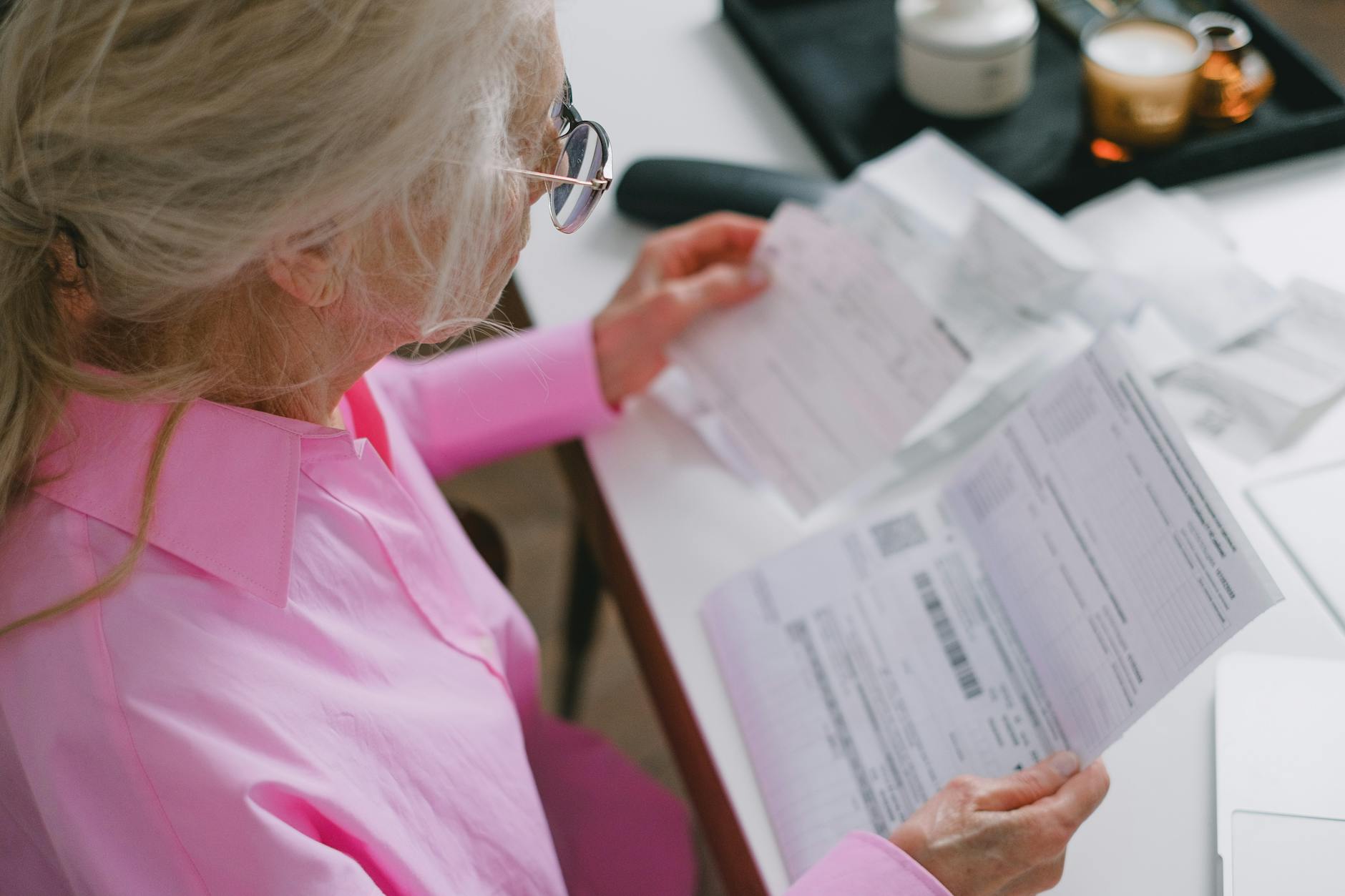

The landscape of healthcare can be complex, particularly for seniors navigating the intricacies of Medicare. One topic that often arises is the need for supplemental insurance and Medigap. Understanding these options is essential for making informed decisions about your healthcare coverage.

What is Medigap?

Medigap, also known as Medicare Supplement Insurance, is a type of policy that helps cover some of the healthcare costs not covered by Original Medicare (Part A and Part B). These costs can include copayments, coinsurance, and deductibles. Essentially, Medigap fills the “gaps” in Original Medicare coverage, providing greater financial security and peace of mind.

How Does Medigap Work?

Medigap policies are sold by private insurance companies and require you to have Original Medicare. Here’s a breakdown of how it works:

- Enrollment: You must have Medicare Part A and Part B to buy a Medigap policy. During the Medigap Open Enrollment Period, which begins the first month you have Medicare Part B and are 65 or older, you can purchase any policy sold in your state without medical underwriting. This period lasts for six months.

- Standardization: Medigap policies are standardized in most states, meaning each policy offers the same basic benefits regardless of the insurance company. However, the cost can vary.

- Coverage: Medigap policies generally cover out-of-pocket costs such as copayments, coinsurance, and deductibles. Some plans may also cover services that Original Medicare does not, such as medical care while traveling outside the U.S.

- Premiums: You pay a monthly premium for your Medigap policy in addition to your Part B premium.

Benefits of Having Medigap

Medigap, also known as Medicare Supplement Insurance, offers numerous advantages for those looking to enhance their healthcare coverage.

Financial Protection

Original Medicare covers a significant portion of healthcare expenses, but it doesn’t cover everything. Without supplemental insurance and Medigap, you could be left paying substantial out-of-pocket costs. Medigap provides financial protection by covering these additional expenses, reducing your overall healthcare costs.

Predictable Costs

With Medigap, you gain more predictability over your healthcare spending. Knowing that your copayments, coinsurance, and deductibles are covered by your policy can help you budget more effectively and avoid unexpected medical bills.

Nationwide Coverage

One of the significant advantages of Medigap is its nationwide coverage. Unlike some Medicare Advantage plans that have network restrictions, Medigap policies allow you to see any doctor or specialist who accepts Medicare, providing greater flexibility and choice in your healthcare providers.

Emergency Foreign Travel Coverage

Some Medigap plans offer coverage for emergency medical care when traveling outside the United States. This benefit can be invaluable for those who enjoy international travel but worry about potential medical emergencies abroad.

Is Medigap Right for You?

Determining whether you need supplemental insurance and Medigap depends on various factors, including your health status, financial situation, and personal preferences. Here are some key considerations:

Health Status

If you have chronic health conditions or anticipate needing frequent medical care, Medigap can provide comprehensive coverage that Original Medicare alone may not suffice. The additional coverage can help manage ongoing medical expenses and ensure you receive the necessary care without financial strain.

Financial Situation

Assess your financial situation and budget for healthcare costs. While Medigap requires paying an additional premium, the financial protection it offers can outweigh this cost, especially if you face high out-of-pocket medical expenses. Consider whether the peace of mind and coverage provided by Medigap align with your financial goals.

Travel Plans

If you plan to travel frequently, especially internationally, Medigap can be a valuable safety net. The coverage for emergency foreign travel ensures you’re protected against unexpected medical expenses while exploring new destinations, giving you confidence and security during your travels.

Research and Studies

Several studies and resources highlight the importance and benefits of supplemental insurance and Medigap:

- Medicare.gov provides comprehensive information on Medigap policies, including coverage details, enrollment periods, and standardization guidelines. It’s an essential resource for understanding how Medigap works and what it can offer.

- A study by the Kaiser Family Foundation found that individuals with Medigap coverage experience lower out-of-pocket costs and greater satisfaction with their healthcare, indicating the positive impact of these policies on financial security and overall well-being.

- According to a report by AARP, Medigap policies contribute to improved access to care, particularly for those with chronic health conditions. The study emphasizes the importance of supplemental insurance in ensuring individuals receive the necessary medical attention without financial barriers.

How to Choose the Right Medigap Policy

Selecting the right Medigap policy involves careful consideration of your healthcare needs, budget, and preferences. Here are some steps to guide you:

Compare Plans

Medigap policies are standardized, but the costs can vary between insurance companies. Use tools like the Medicare Plan Finder to compare the benefits and premiums of different plans available in your area. Look for policies that align with your coverage needs and budget.

Evaluate Insurance Companies

Research the reputation and financial stability of insurance companies offering Medigap policies. Check customer reviews and ratings to ensure you choose a reliable provider that offers excellent customer service and support.

Understand the Fine Print

Read the policy documents carefully to understand the coverage details, exclusions, and any limitations. Pay attention to factors such as renewal guarantees and potential rate increases to avoid surprises down the road.

Seek Professional Advice

Consider consulting with a licensed insurance agent or financial advisor specializing in Medicare and Medigap policies. They can provide personalized guidance based on your specific circumstances and help you make an informed decision.

Seek an advice with your agent

In the evolving landscape of healthcare, supplemental insurance and Medigap play a crucial role in providing financial protection and comprehensive coverage for seniors and health-conscious individuals. By filling the gaps in Original Medicare, Medigap ensures you can access the care you need without the burden of excessive out-of-pocket costs.

Take the time to research your options, assess your healthcare needs, and make an informed decision about whether Medigap is right for you. Remember, the right supplemental insurance can offer not only financial security but also peace of mind, allowing you to focus on what matters most, your health and well-being.